Table of Content

Knowing the present value of an annuity may be useful when planning your retirement and your monetary future in general. If you may have the option of choosing an annuity or a lump-sum cost, you’ll need to understand how a lot your remaining annuity funds are price so you possibly can select. Even if you aren’t making that call, figuring out the present value of an annuity can give you a clearer image of your finances. The low cost fee refers to an interest rate or an assumed fee of return on different investments over the same length as the payments. The smallest discount rate utilized in these calculations is the risk-free fee of return. Treasury bonds are generally thought of to be the closest factor to a risk-free funding, so their return is usually used for this objective.

According to the Internal Revenue Service, most states require factoring corporations to disclose low cost charges and current value during the transaction course of. Let us take the example of an annuity of $5,000 which is anticipated to be obtained annually for the subsequent three years. Calculate the present worth of the annuity if the discount price is 4% whereas the payment is received initially of every 12 months.

Calculating Present Worth

David Kindness is a Certified Public Accountant and an skilled within the fields of monetary accounting, company and particular person tax planning and preparation, and investing and retirement planning. David has helped hundreds of purchasers improve their accounting and monetary systems, create budgets, and reduce their taxes. On the other hand, if the money move is to be acquired at the finish of each interval, then the formula for the present value of an strange annuity may be expressed as shown under. Using the above formulation, you'll have the ability to determine the present worth of an annuity and determine if taking a lump sum or an annuity cost is a more environment friendly choice. It is important because capital expenditure requires a considerable quantity of funds. Bonds are often ordinary annuities as a result of they're paid on the end of a interval.

This makes it easier so that you simply can plan in your future and make sensible financial choices. Many websites, including Annuity.org, offer online calculators that can assist you discover the present worth of your annuity or structured settlement payments. These calculators use a time worth of money method to measure the current price of a stream of equal funds on the finish of future periods. The present worth interest issue of an annuity is helpful when figuring out whether or not to take a lump-sum fee now or accept an annuity payment in future durations.

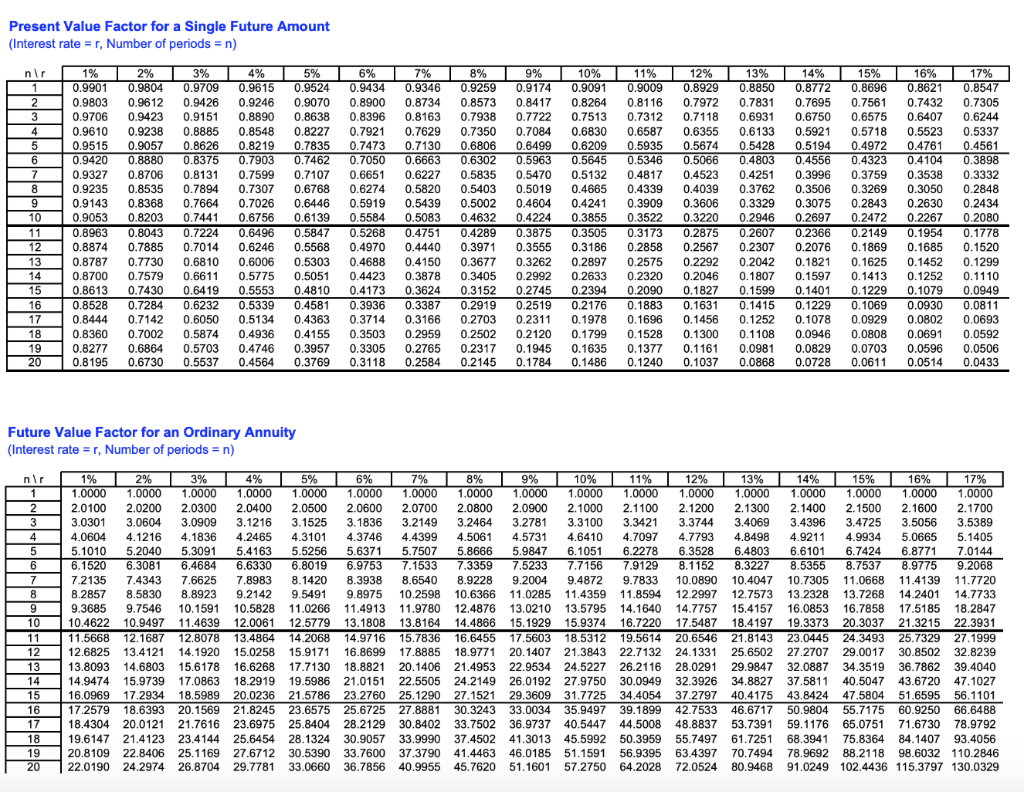

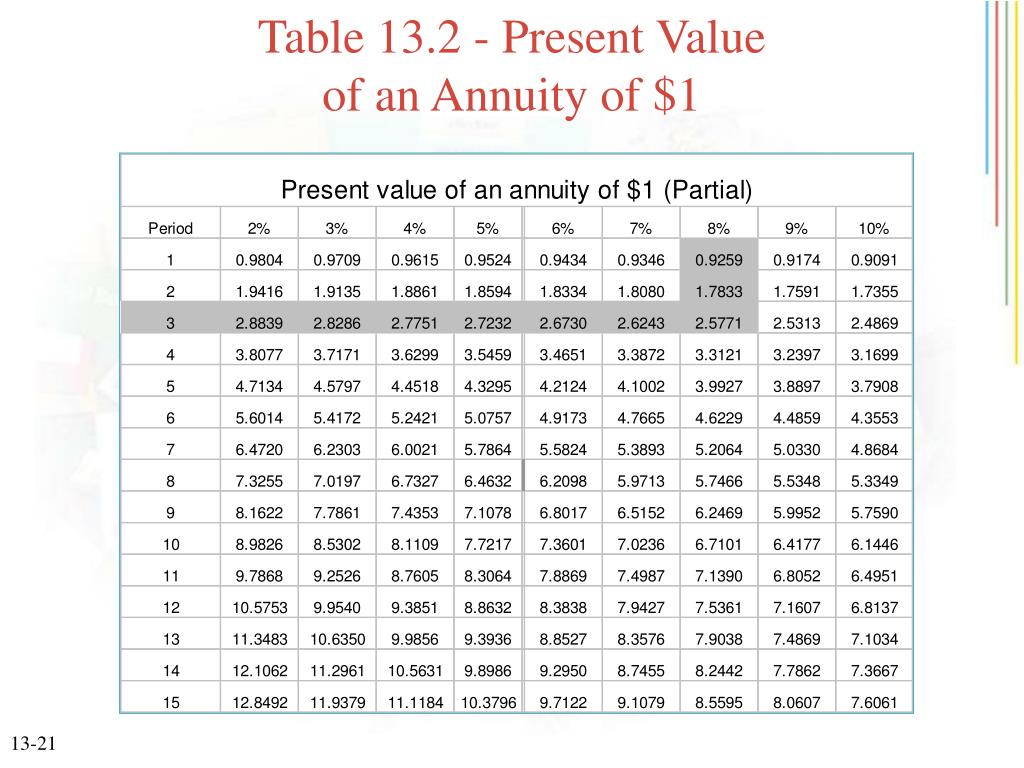

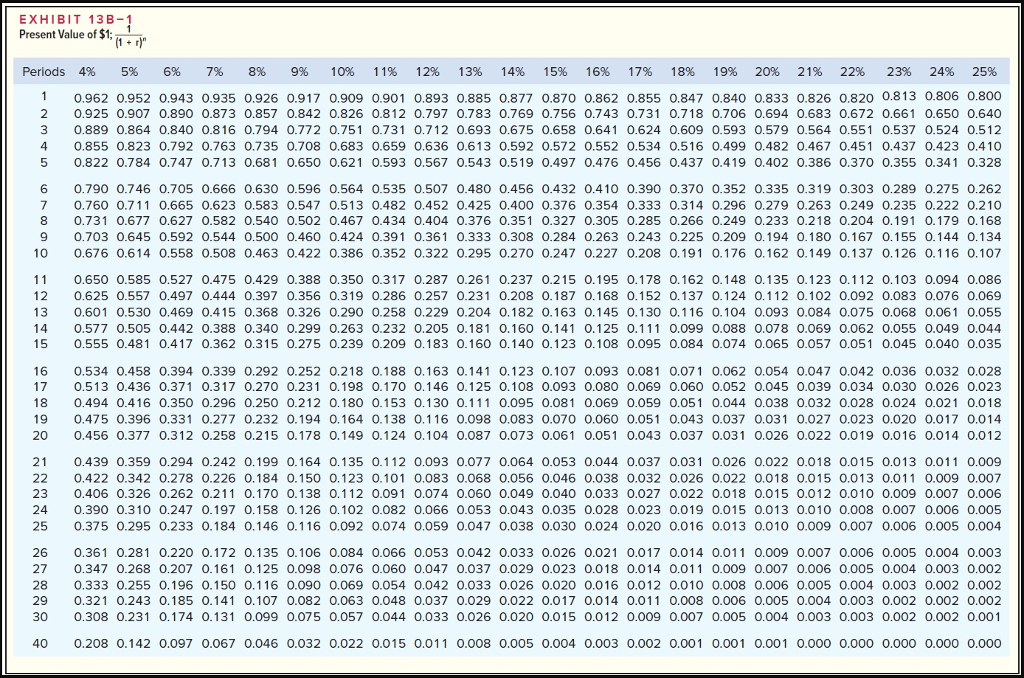

Present Value Interest Issue Of An Annuity, With Tables

If you need to understand how a lot cash you will need to retire, SmartAsset’sretirement calculator can help you determine how much you’ll must stash away to stay comfortably. The current worth of an annuity is set through the use of the next variables within the calculation. Click right here to join our newsletter to be taught extra about monetary literacy, investing and necessary shopper financial news. The present value of annuity table is available for download in PDF format by following the hyperlink under. These are only a few of the elements that may have an effect on the current worth of an annuity. Compounding is the method by which an asset’s earnings, from either capital positive aspects or curiosity, are reinvested to generate extra earnings.

The present value of annuity is usually used to determine the money worth of recurring payments in court settlements, retirement funds and loans. It is also used to calculate whether a mortgage fee is above or under an expected value. With an annuity, you might be comparing the worth of taking a lump sum versus the annuity funds. Calculating the current value of annuity lets you decide which is extra priceless to you. It’s also important to notice that the value of distant funds is much less to purchasing firms as a outcome of financial elements. The sooner a fee is owed to you, the more money you’ll get for that fee.

In this situation, you could take a lump sum or $300,000, with a 5% discount rate. While not the most advanced formula, it could nonetheless be tough to calculate the current worth of an annuity. You can thank the variety of variables options in the formulation for that. The purpose the values are higher is that payments made at the beginning of the period have extra time to earn interest. For example, if the $1,000 was invested on January 1 somewhat than January 31 it will have a further month to develop. The present worth is how a lot cash could be required now to supply those future payments.

The present value curiosity factor of an annuity is used to calculate the present worth of a series of future annuities. PVIFA can be a variable used when calculating the present worth of an odd annuity. Roger Wohlner is a financial advisor with 20 years of experience in the trade. He has been featured on Morningstar Magazine, Go Banking Rates, U.S. News & World Report, Yahoo Finance, The Motley Fool, Money.com, and quite a few other sites. Roger acquired his MBA from Marquette University and his bachelor's in finance from the University of Wisconsin-Oshkosh.

We create quick videos, and clear examples of formulation, functions, pivot tables, conditional formatting, and charts. With that in mind, you could additionally want to take a look at different variables, particularly if you’re a secondary market buyer. At 10% curiosity compounded yearly, the current worth of this annuity is $94,775.

Determine the present value of this collection assuming an rate of interest of 12% per 12 months compounded semiannually. This article explains the computation of present worth of an annuity. If you wish to learn the computation of present value of a single sum to be obtained or paid in future, learn ‘present value of a single fee in future’ article. Payment/Withdrawal Frequency – The payment/deposit frequency you want the present worth annuity calculator to use for the current value calculations. Annual Interest Rate (%) – This is the rate of interest earned on the annuity. The present value annuity calculator will use the interest rate to discount the fee stream to its present worth.

Annuity means a stream or collection of equal funds; for instance, you have made an investment that may generate an interest earnings of $5,000 for you at the end of each yr for 5 years. The calculation of PVIFA relies on the concept of the time value of cash. This idea stipulates that the worth of forex acquired at present is value more than the value of forex received at a future date. This is because the currency acquired today could additionally be invested and can be used to generate interest. Present Value Of An Annuity – Based on your inputs, this is the current worth of the annuity you entered info for. The present worth of any future value lump sum and future money flows .

He has been the CFO or controller of each small and medium sized firms and has run small businesses of his own. He has been a manager and an auditor with Deloitte, an enormous four accountancy agency, and holds a degree from Loughborough University. Present value calculations are influenced by when payments might be disbursed. That means the payment will start initially or end of a period.

To put that more succinctly, the upper the discount price, the decrease the annuity’s present value. For instance, a court docket settlement may entitle the recipient to $2,000 per 30 days for 30 years, however the receiving party may be uncomfortable getting paid over time and request a money settlement. The equivalent worth would then be decided by using the present value of annuity formulation. The result will be a present value cash settlement that might be less than the sum whole of all the future payments due to discounting . An annuity is a financial contract you enter with an insurance firm.

No comments:

Post a Comment