Table of Content

According to the Internal Revenue Service, most states require factoring companies to reveal low cost charges and current worth in the course of the transaction course of. Let us take the example of an annuity of $5,000 which is anticipated to be received annually for the next three years. Calculate the present worth of the annuity if the low cost fee is 4% while the cost is acquired initially of each yr.

First enter the quantity of the payment that you’ve been making, the account’s interest rate, the number of years you’ve been making these deposits, and the fee interval. Future worth is the value of a present asset at a future date based on an assumed rate of development over time. Given this info, the annuity is value $10,832 much less on a time-adjusted basis, so the individual would come out forward by choosing the lump-sum payment over the annuity. Email or call our representatives to search out the value of these more complicated annuity payment varieties. Annuity due refers to funds that occur regularly initially of every interval. Rent is a traditional instance of an annuity due as a outcome of it’s paid firstly of each month.

How Does Odd Annuity Differ From Annuity Due?

This would aid them in making sound funding choices primarily based on their anticipated wants. However, external economic factors, such as inflation, can adversely have an result on the future value of the asset by eroding its worth. An odd annuity makes funds at the finish of every time period, while an annuity due makes them at the beginning. All else being equal, the annuity due might be value more within the current.

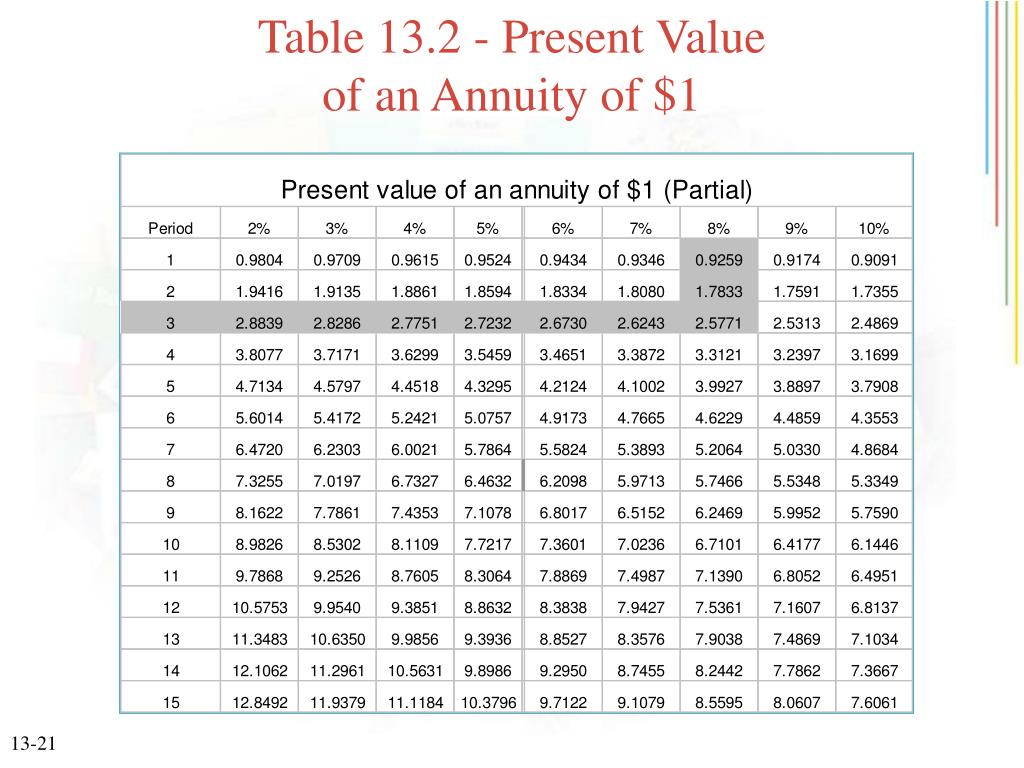

It is used to estimate how a lot cash an annuity will be price at a given point sooner or later. This calculation is important for companies and people who wish to know how a lot cash they'll have obtainable sooner or later. In this information, we'll walk you thru how to calculate annuity to present value. We may also discuss a few of the components that have an result on this calculation. Also often recognized as a “present worth table,” an annuity desk is a device that simplifies the calculation of the current value of an annuity. And, all you have to do is multiply the current worth curiosity issue of an annuity along with your recurring fee amount to get the current value of your annuity.

Calculating The Rate Of Return For Annuities

Knowing the present value of an annuity may be useful when planning your retirement and your financial future normally. If you've the option of selecting an annuity or a lump-sum fee, you’ll need to know how much your remaining annuity funds are value so you probably can choose. Even when you aren’t making that call, knowing the current value of an annuity may give you a clearer picture of your funds. The low cost fee refers to an interest rate or an assumed price of return on different investments over the identical duration because the funds. The smallest low cost rate utilized in these calculations is the risk-free rate of return. Treasury bonds are typically thought-about to be the closest factor to a risk-free investment, so their return is usually used for this function.

You’ll pay a certain amount of money upfront or as a half of a cost plan, and get a predetermined annual cost in return. You can receive annuity payments either indefinitely or for a predetermined size of time. The present worth of an annuity is the cash worth of all your future annuity payments. An annuity’s future payments are lowered primarily based on the discount fee. Thus, the upper the discount rate, the lower the current value of the annuity is.

In contrast, web present value is derived by deducting the present worth of all the company's money outflows from the current value of the whole money inflows of the corporate. Suppose that there's an annuity fee of $1,000 for the subsequent 25 years beginning at every end of the yr. You are required to compute the current value of the annuity, assuming a price of interest is 5%. CompoundingCompounding is a technique of investing during which the revenue generated by an investment is reinvested, and the model new principal quantity is elevated by the amount of revenue reinvested. Depending on the time interval of deposit, curiosity is added to the principal quantity.

Not at all times understanding what the total cash value of your future annuity funds shall be. Knowing this upfront lets you plan accordingly, like setting a retirement price range or figuring out how much to save every month. This is very true if you want to complement different retirement earnings streams, like Social Security. Or if you’re shedding sleep over whether you’re going to outlive your savings or not. After you’ve stopped working, you’ll be relying in your financial savings and Social Security payments to support yourself and revel in your golden years.

We make no guarantee or representation as to its accuracy and we're lined by the phrases of our legal disclaimer, which you're deemed to have learn. This is an instance of an annuity issue table that you simply may use when contemplating the method to calculate annuity values. This isn't intended to replicate basic requirements or targets for any explicit enterprise, company or sector. If you do spot a mistake in these time value of money tables, please let us know and we'll try to repair it.

While this may be a easy and efficient approach to find the current worth of an annuity, it’s not as effective as handbook calculations or calculators. If you want even more details concerning the present worth of your funds, schedule an appointment along with your monetary advisor. They can evaluation the estimate and give you extra data and steerage.

Relevance And Makes Use Of Of Present Worth Of Annuity Method

The presents that seem in this desk are from partnerships from which Investopedia receives compensation. Investopedia does not embrace all provides obtainable within the market. Investopedia requires writers to use main sources to help their work. These include white papers, government information, unique reporting, and interviews with industry consultants. We additionally reference authentic analysis from different respected publishers where applicable.

Real property investors also use the Present Value of Annuity Calculator when buying and selling mortgages. This reveals the investor whether or not the value he is paying is above or under anticipated value. The current worth of an annuity is based on the time value of cash. You can make investments cash to earn more money through interest and other return mechanisms, which means that getting $5,000 right now may be extra valuable than being promised $5,000 in five years. The fee of return you’ll earn from investing that $5,000 means that by the point you'd get the $5,000 in five years, the $5,000 you'd get now can be price extra money. The following table shows present charges for savings accounts, interst bearing checking accounts, CDs, and cash market accounts.

The present worth of an annuity is the amount of money that you'd need to speculate at present to have the ability to obtain a specified stream of funds sooner or later. This calculation is affected by the rate of interest, the size of time till the payments are obtained, and the quantity of each cost. It is essential to think about all of those elements when making a choice about whether or not or not to put money into an annuity.

That's because $10,000 today is value more than $10,000 obtained over the course of time. In other words, the buying energy of your cash decreases sooner or later. Therefore, the current value of the money influx to be received by David is $20,882 and $20,624 in case the payments are obtained initially or at the end of every quarter respectively. An annuity due is the kind of annuity that requires a cost firstly of a interval.

No comments:

Post a Comment